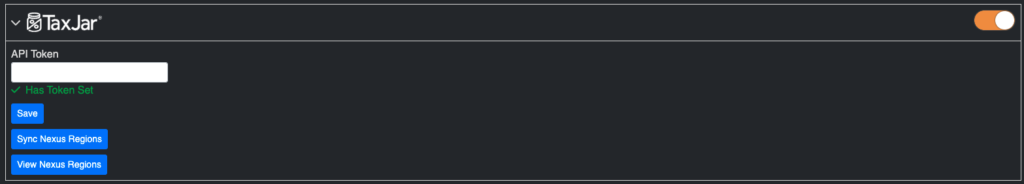

First toggle on the integration by clicking the toggle button on the Integration:

Then open up the Integration by clicking the chevron on the left hand side:

Once toggled on, you will need to generate an API Token from your TaxJar account. With that token, paste it into the API Token box, and click Save. Once done click ‘Sync Nexus Regions’ for those to pull down.

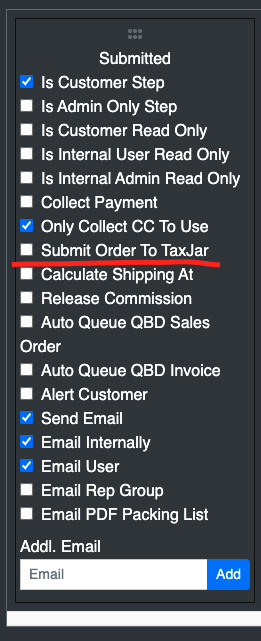

After these initial setup items, you’ll be able to do the following from within Orderwerks:

Note: If no TaxJar category is selected for a catalog item, then it will be considered general merchandise and be treated as such.

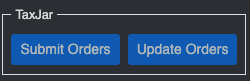

You can also manually select Orders for submitting or updating to TaxJar from the Orders screen:

Update Orders is necessary if you make changes to the Order AFTER sending the Orders to TaxJar.

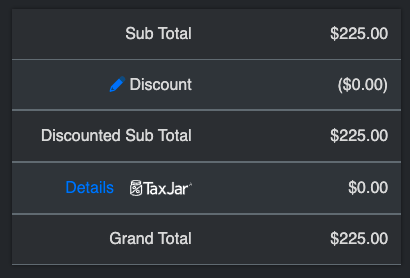

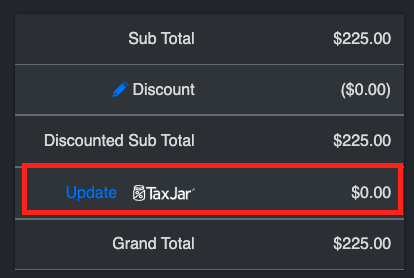

Inside of an Order Entry, you can click Update next to TaxJar in the Totals Box to get the Sales Tax Calculation from TaxJar. Since TaxJar charges you based on usage, we leave this for manual processing, in order to minimize TaxJar costs for your business.

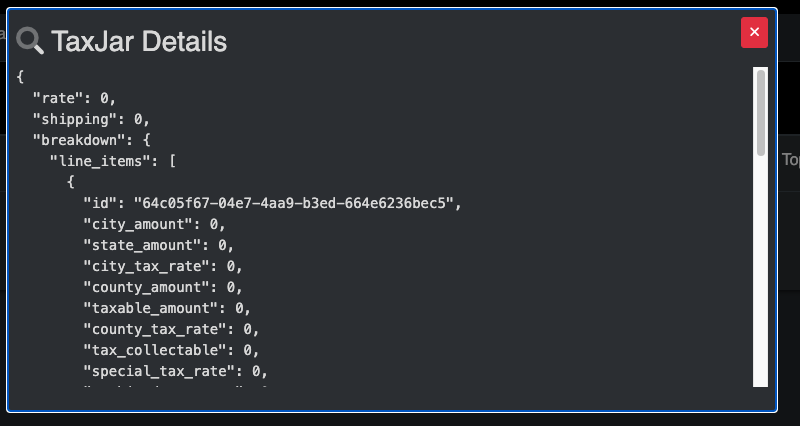

Once you update the tax with this, you’ll get a detail of how it calculated the Tax on the Order with clicking the Details button: